What Are Wall Street Analysts' Target Price for Corning Stock?

/Corning%2C%20Inc_%20logo%20and%20website-by%20T_Schneoder%20via%20Shutterstock.jpg)

With a market cap of $54.1 billion, Corning Incorporated (GLW) is a global technology company that develops and manufactures specialty glass, ceramics, and optical physics-based products for a wide range of industries. It serves key markets including optical communications, display technologies, specialty materials, environmental technologies, and life sciences.

Shares of the Corning, New York-based company have outpaced the broader market over the past 52 weeks. GLW stock has surged 67.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 21.5%. Moreover, shares of Corning have soared 32.9% on a YTD basis, compared to SPX's 7.1% rise.

Looking closer, the specialty glass maker stock has also outperformed the Technology Select Sector SPDR Fund's (XLK) return of 31.4% over the past 52 weeks and a 11.9% increase on a YTD basis.

Shares of Corning climbed 11.9% on Jul. 29 after the company reported stronger-than-expected Q2 2025 adjusted EPS came in at $0.60 and core sales reached $4.05 billion. Its largest segment, Optical Communications, saw a 41% year-over-year sales increase to $1.6 billion, driven by AI-fueled demand for optical connectivity in hyperscale data centers. Corning also guided Q3 core sales of $4.2 billion and EPS of $0.63 - $0.67, both ahead of Wall Street estimates, further boosting investor confidence.

For the fiscal year ending in December 2025, analysts expect GLW's adjusted EPS to grow 24.5% year-over-year to $2.44. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

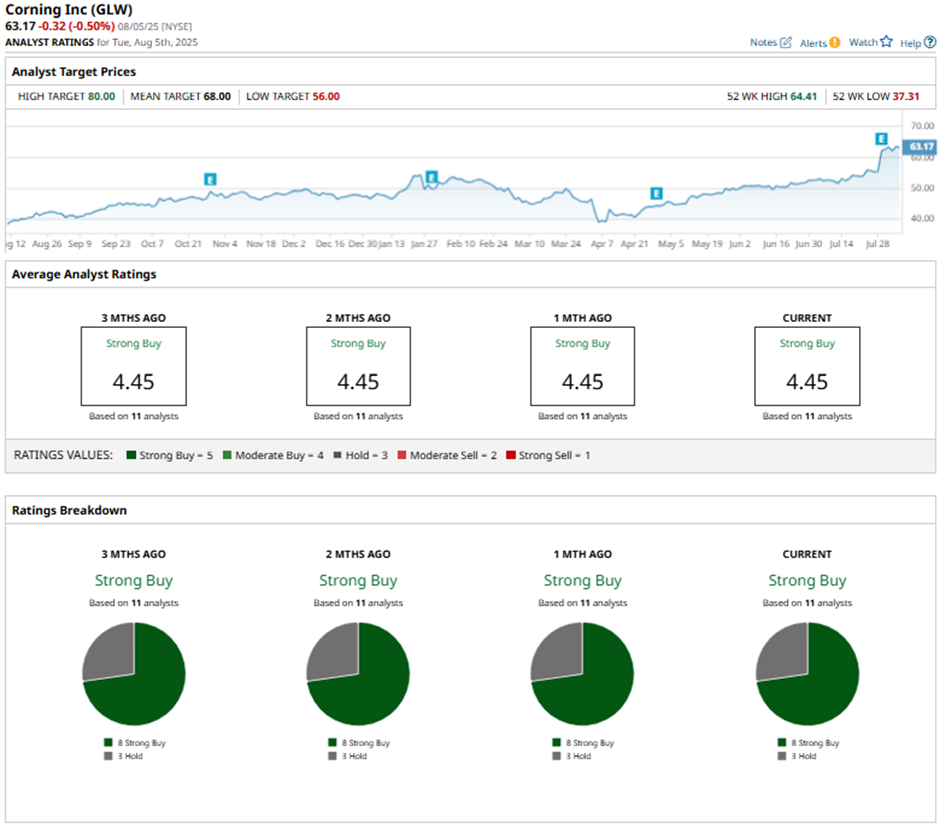

Among the 11 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on eight “Strong Buys” and three “Holds.”

On Jul. 30, Oppenheimer raised Corning’s price target to $72 and maintained an “Outperform” rating. The firm cited strong Q3 guidance and growth potential from Corning’s Springboard plan and U.S. manufacturing footprint.

As of writing, the stock is trading below the mean price target of $68. The Street-high price target of $80 implies a potential upside of 26.6% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.