Is Wall Street Bullish or Bearish on Estée Lauder Stock?

Valued at a market cap of $32.7 billion, The Estée Lauder Companies Inc. (EL) is a global leader in prestige beauty, offering skincare, makeup, fragrance, and hair care products. The New-York based company’s portfolio includes iconic brands like Estée Lauder, MAC, Clinique, La Mer, and Jo Malone London. It operates through a mix of department stores, specialty retailers, e-commerce, and travel retail channels across over 150 countries.

EL shares have struggled to keep up with the broader market over the past 52 weeks. Shares of EL have dropped 3.5% over this time frame, while the broader S&P 500 Index ($SPX) has soared 21.1%. However, on a YTD basis, the stock has surged 20.2%, compared to SPX’s 7.9% rise.

Narrowing the focus, EL has also trailed the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.3% uptick over the past 52 weeks but has surpassed the ETF’s 3.8% rise on a YTD basis.

On May 29, Estée Lauder shares rose over 3%, following the announcement of Lisa Sequino’s appointment as president of its makeup brand cluster. With a strong track record as former CEO of Supergoop! and JLo Beauty & Lifestyle, Sequino’s hiring was seen as a strategic move that bolstered investor confidence and lifted the stock.

For the fiscal year that ended in June, analysts expect EL’s EPS to decline 42.1% year over year to $1.50. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

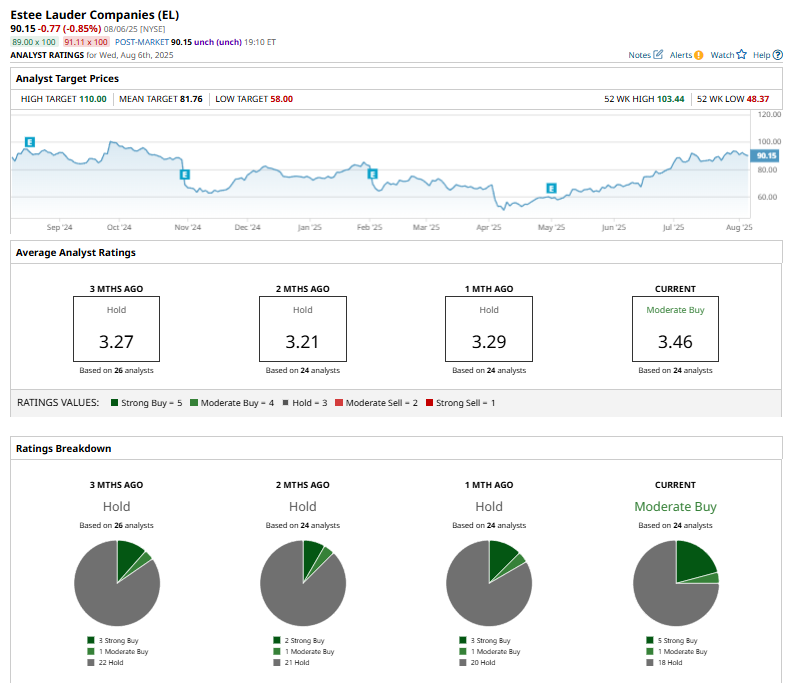

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy” which is based on five “Strong Buy,” one “Moderate Buy,” and 18 “Hold” ratings.

This configuration is more bullish than a month ago, with three analysts suggesting a “Strong Buy” rating.

On July 25, JPMorgan Chase & Co. (JPM) upgraded Estée Lauder from "Neutral" to "Overweight" and raised its price target from $62 to $101, reflecting growing confidence in the company’s near-term growth and market potential.

While EL currently trades above its mean price target of $81.76, the Street-high price target of $110 suggests an upside potential of 22% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.