2 Dividend Stocks Yielding 7% to Pounce on Now

Amid trade tensions, a geopolitical crisis, and recession fears, investors are looking for stocks that offer a sense of security. Dividend stocks serve that purpose. Some of them not only provide a high yield, but also consistently pay and increase their dividends, making them a great addition to any portfolio.

Here are two dividend stocks with a high yield, a track record of consistent dividend payments, and a dependable business model that generates steady cash flow.

Dividend Stock #1: Enterprise Products Partners

Dividend Yield: 7%

With a market cap of $67.6 billion, Enterprise Products Partners (EPD) is widely regarded as one of the most dependable and appealing income-generating stocks in the energy sector. It manages one of the largest and most diverse portfolios of midstream energy infrastructure assets in North America. EPD’s midstream operations include crude oil (CLU25), natural gas (NGU25), and petrochemicals.

It combines the stability of essential infrastructure with the advantages of a master limited partnership (MLP) structure, resulting in strong cash flow generation and a long track record of capital returns to shareholders.

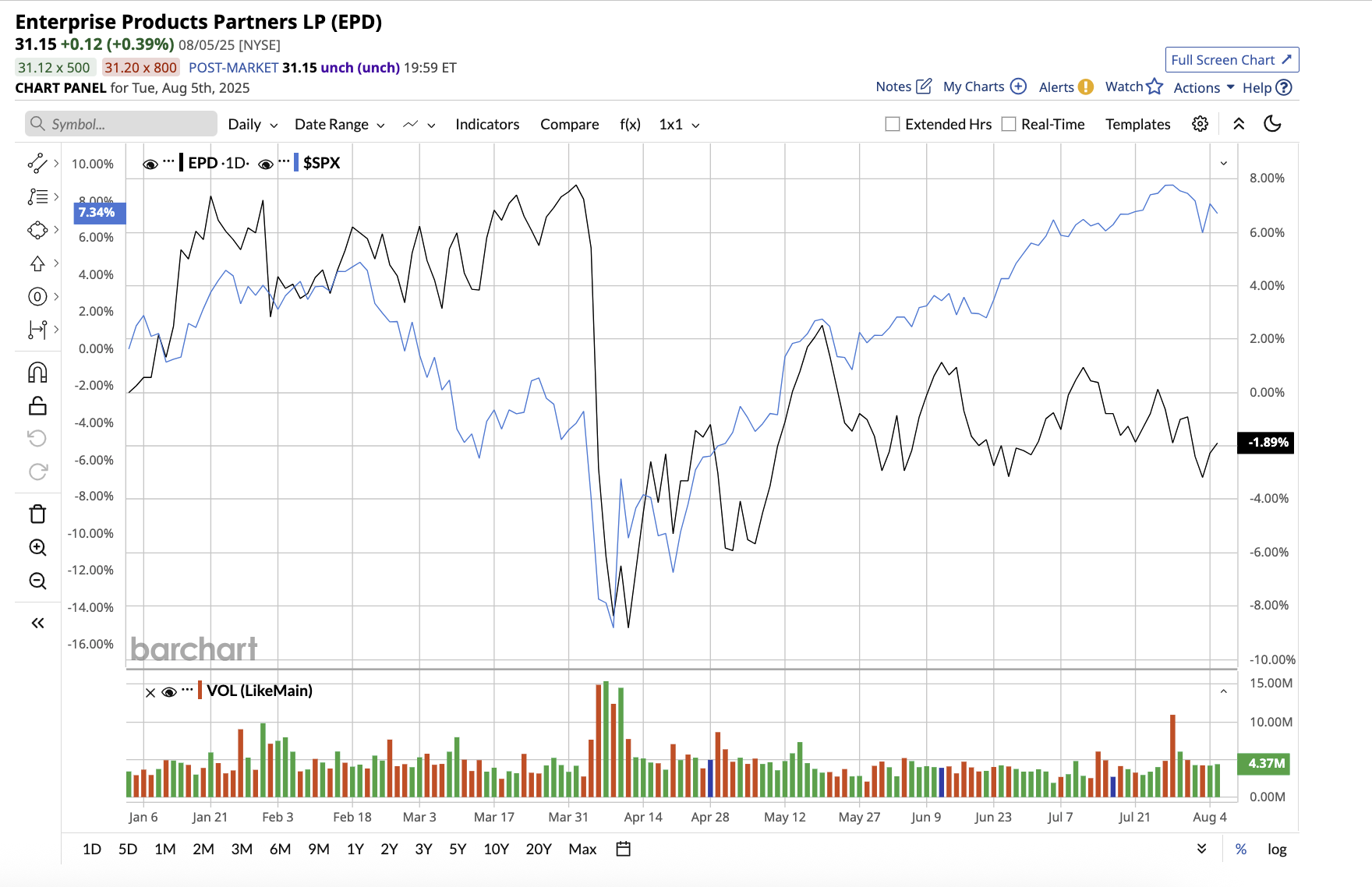

EPD shares have dipped 0.2% year-to-date, compared to the broader market gain.

The beauty of EPD’s business model is its fee-based structure, which enables it to generate consistent and predictable cash flows regardless of commodity prices. This reduces the company's exposure to price volatility and increases its resilience during market downturns. The company generates significant distributable cash flow (DCF), which supports its current dividend payout ratio of 74.4%, leaving plenty of room to reinvest in growth without compromising investor returns.

In the second quarter, DCF of $1.9 billion increased 7% year-over-year. Net income increased by 3%, reaching $0.66 per share. EPD also announced a 3.8% quarterly dividend increase, to $0.545 per share. The company generated adjusted free cash flow of $812 million, which allowed it to continue paying dividends.

With a 7% yield, higher than the energy sector average of 4.2%, a conservative balance sheet, and a strategic position in the U.S. energy sector, EPD provides a unique combination of income and resilience in an uncertain macro environment. Additionally, with 28 consecutive years of distribution growth, a payout well-covered by stable cash flows, and a best-in-class midstream asset base, EPD is arguably one of the best dividend stocks.

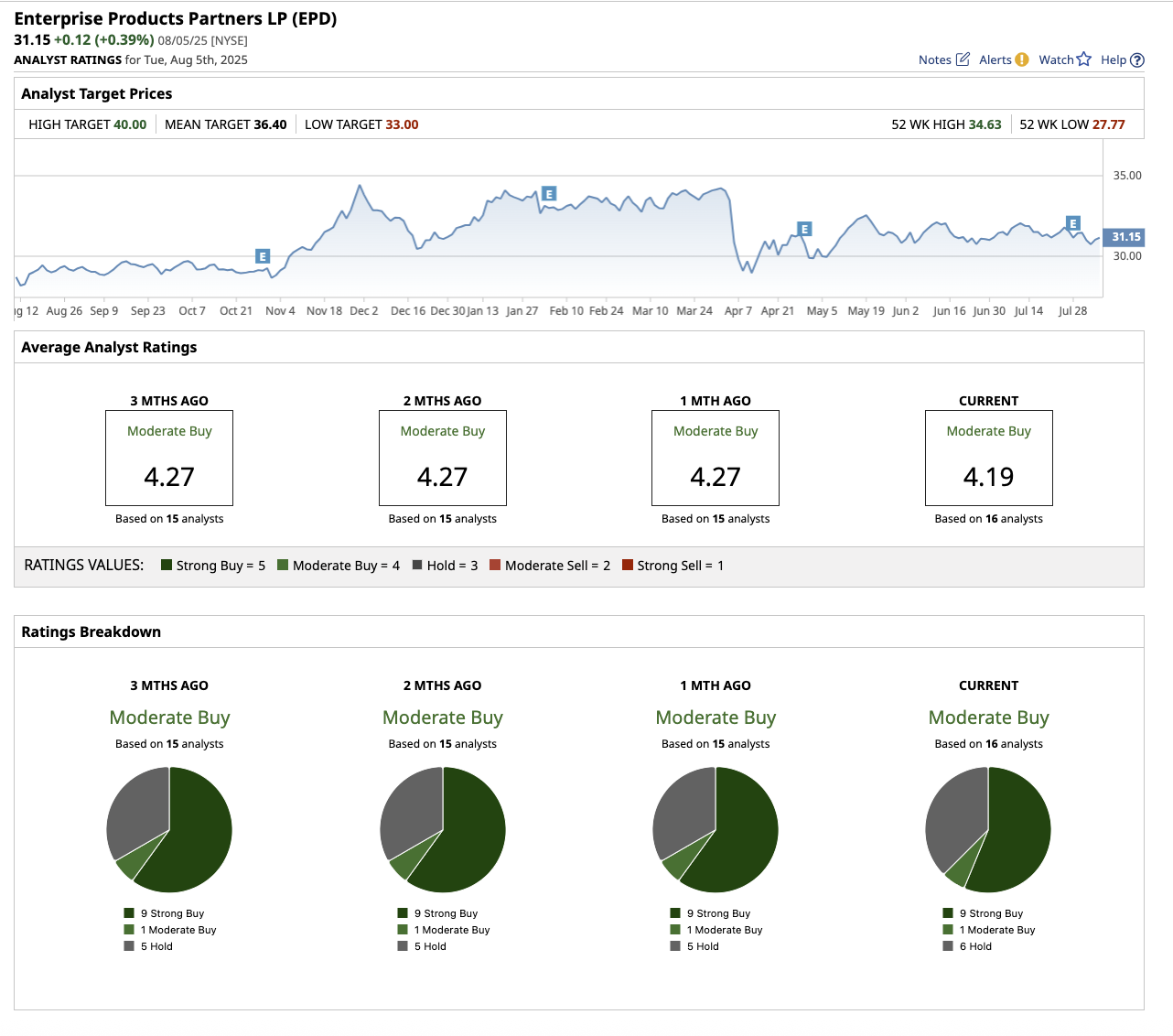

Overall, Wall Street rates EPD stock a “Moderate Buy.” Out of the 16 analysts who cover EPD, nine recommend a “Strong Buy,” one rates it a “Moderate Buy,” and six recommend a “Hold.” The average analyst price target of $36.40 represents a potential 16% increase from current levels. Its high target price of $40 suggests the stock could climb by another 29% over the next 12 months.

Dividend Stock #2: Altria

Dividend Yield: 6.5%

Valued at $105 billion, Altria (MO) is a manufacturer and seller of tobacco, nicotine, and smokeless products. Besides tobacco, Altria also has investments in alcohol and cannabis to diversify its revenue streams. Altria’s business model is centered around addictive and recession-proof products, which generate steady cash flow. Despite declining cigarette volumes amid health concerns and heightened regulatory pressure, the company has managed to sustain its dividend and even grow it.

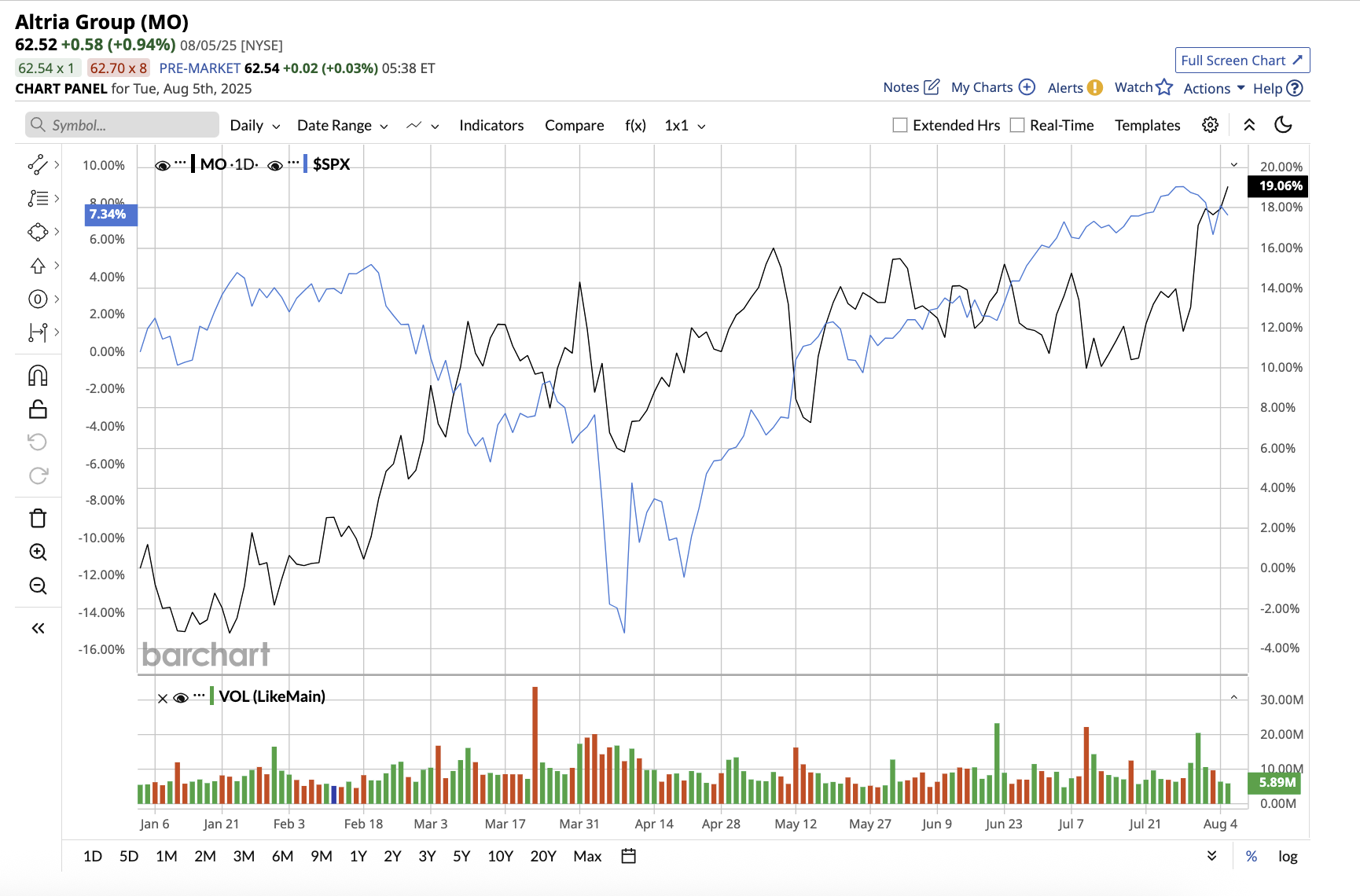

Altria stock has surged 21.3% year-to-date, compared to the broader market gain of 7.6%.

Altria’s reputation as a Dividend King (companies that increase dividends consecutively for 50 years) is built on decades of reliable payouts and hikes. The company has raised its dividend 59 times in the past 55 years, an enviable record. Altria hiked its quarterly dividend by 4.1% last year to $1.02 per share, marking the 59th increase. This consistency stems from the company’s predictable cash flow, which in turn is driven by the remarkably inelastic demand for cigarettes, its core product. Despite a long-term decline in smoking rates, Altria has managed to offset volume losses through price hikes, cost control, and strong brand loyalty. Even as cigarette volumes decline, the pricing power of Marlboro and other premium brands enables Altria to maintain healthy margins.

Currently, its dividend yield sits around 6.5%, which is higher than the consumer staples sector average of 1.9%. Altria’s capital allocation strategy is heavily geared toward returning capital to shareholders. While the forward dividend payout ratio is high at 73%, it also reflects management’s confidence in the stability of its earnings. This payout level is sustainable as long as adjusted earnings remain stable or grow modestly. In the most recent second quarter, adjusted earnings increased by 8.3% to $1.44 per share. The company paid $1.7 billion in dividends and repurchased shares worth $274 million in share repurchases in Q2. Analysts expect earnings to increase by 6.1% for the full year, followed by another 2.5% in 2026.

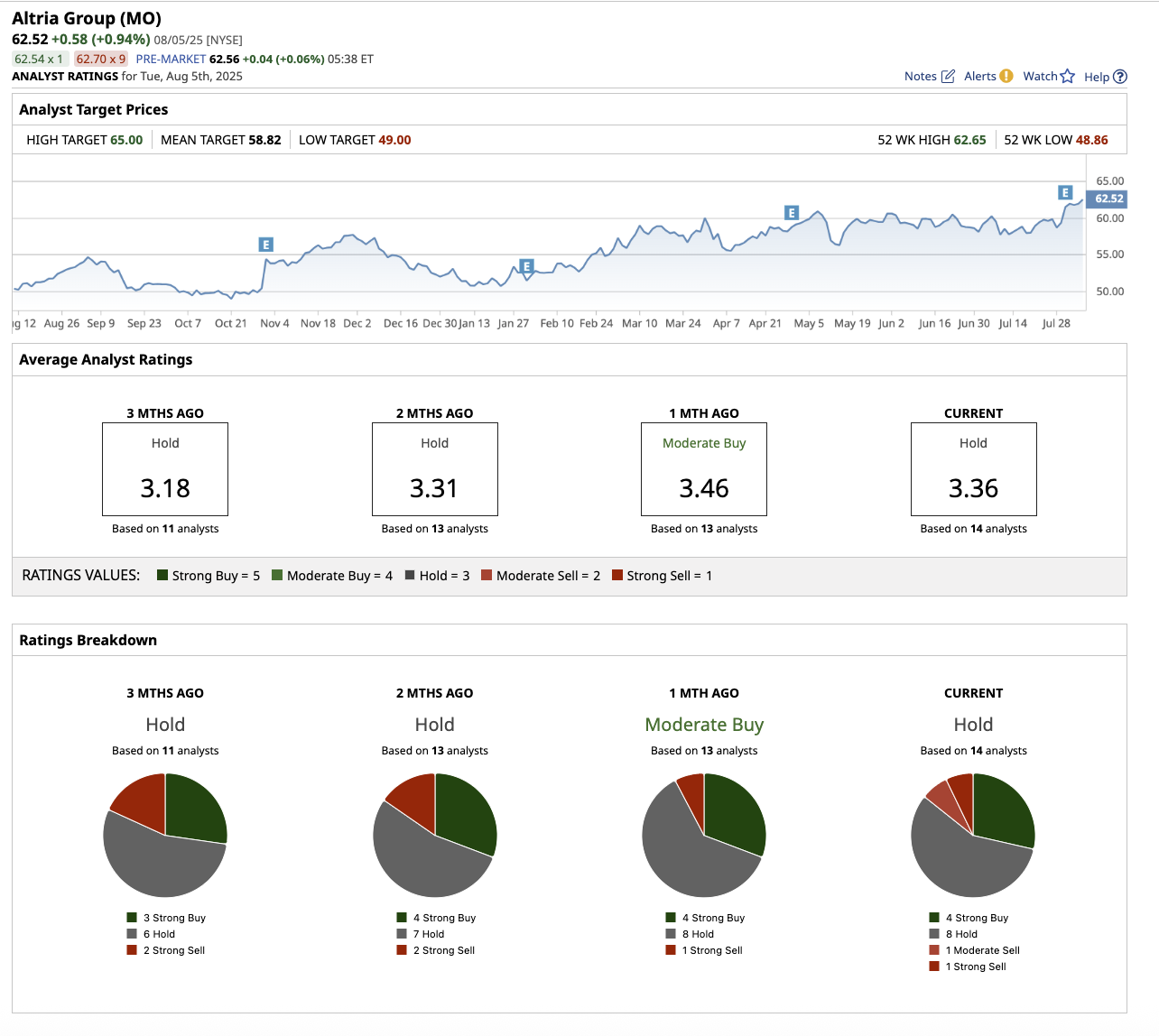

Overall, on Wall Street, Altria stock is a “Hold.” Of the 14 analysts who cover MO, four rate it a “Strong Buy,” eight rate it a “Hold,” one rates it a “Moderate Sell,” and one recommends a “Strong Sell.”

Altria stock has surpassed its average price target of $58.82. However, its high target price of $65 indicates that the stock could rise by 2% from current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.