Do Wall Street Analysts Like Skyworks Solutions Stock?

/Skyworks%20Solutions%2C%20Inc_%20logo%20on%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

Skyworks Solutions, Inc. (SWKS) is a leading semiconductor company headquartered in Irvine, California, with a market cap of approximately $10.2 billion. Operating within the technology sector and specializing in the semiconductor industry, Skyworks designs, develops, and manufactures high-performance analog and mixed-signal solutions.

Its product portfolio includes amplifiers, RF switches, front-end modules, filters, and power management integrated circuits, which enable seamless wireless connectivity across a wide range of applications, from smartphones and consumer electronics to automotive, industrial, and IoT devices. With its innovation-driven approach, Skyworks plays a crucial role in powering the connected world.

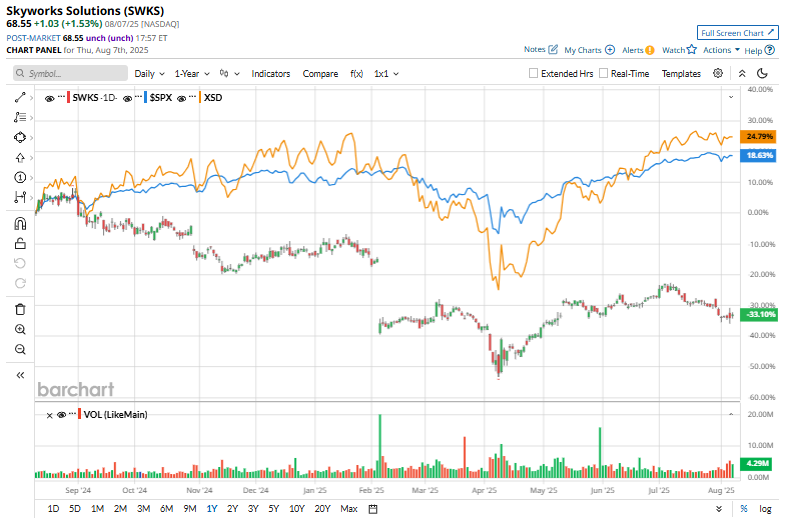

Shares of the chipmaker have underperformed significantly in 2025, down 22.7% on a year-to-date (YTD) basis. This decline sharply contrasts with the S&P 500 Index’s ($SPX) returns of 7.8% over the same period. Over the past 52 weeks, SWKS stock has declined by 28.9%, while the SPX rallied 21.9%.

Zooming in further, the SPDR Semiconductor ETF (XSD) has surged by 7.7% YTD. Over the past 52 weeks, XSD has shown even greater strength, delivering a 32.8% return, while Skyworks’s shares remain significantly lower, reflecting the stock’s persistent underperformance against semiconductor sector peers.

This downward pressure stems from a mix of sector-wide challenges such as trade tensions, volatile semiconductor demand, and macroeconomic uncertainty, as well as company-specific factors.

Although Skyworks recently (on Aug. 5) reported Q3 revenue of $965 million, up 6.6% year-over-year (YoY), its net income fell 13.2% to $105 million. Nevertheless, on a non-GAAP basis, EPS came in at $1.33, beating expectations.

Meanwhile, analysts seem bearish as they project Skyworks to report an EPS decline of 26.5% YoY to $3.92, on a diluted basis, for the current fiscal year, ending in September 2025. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters, while missing the forecast in the other two other quarters.

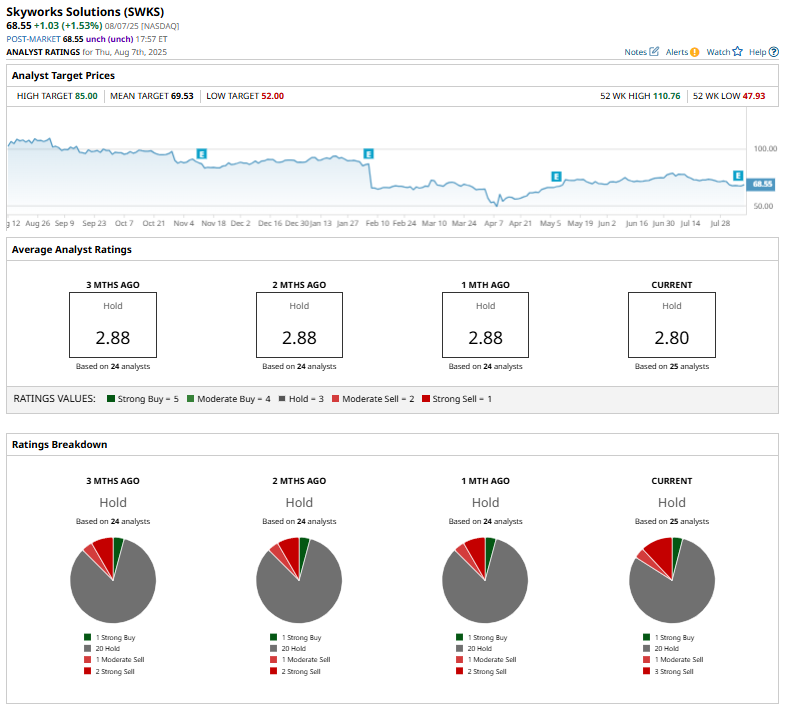

Among the 25 analysts covering SWKS stock, the consensus rating is a “Hold.” That’s based on just one analyst recommending a “Strong Buy,” a majority of 20 analysts are playing it safe with a “Hold rating,” one has a “Moderate Sell,” and the remaining three have “Strong Sell” ratings.

The current configuration has remained largely consistent over the past few months.

Recently, Morgan Stanley lowered its price target on SWKS to $65 from $68, maintaining an “Equalweight” rating. The firm cited concerns over content losses to Broadcom Inc. (AVGO). Also, Morgan Stanley believes that while the company is delivering stable numbers, these results may only delay broader headwinds.

The mean price target of $69.53 is not quite as ambitious, representing only a slight upside to SWKS’ current price. The Street-high price target of $85 suggests an upside potential of 24%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.