Is Wall Street Bullish or Bearish on Constellation Energy Stock?

Constellation Energy Corporation (CEG), headquartered in Baltimore, Maryland, produces and sells energy products and services. With a market cap of $106.1 billion, the company generates and distributes nuclear, hydro, wind, and solar energy solutions serving homes, institutional customers, public sectors, community aggregations, and businesses.

Shares of this nuclear-heavy giant have outperformed the broader market over the past year. CEG has gained 87.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 21.9%. In 2025, CEG stock is up 50.4%, surpassing SPX’s 7.8% gains on a YTD basis.

Zooming in further, CEG’s outperformance is also apparent compared to the Utilities Select Sector SPDR Fund (XLU). The exchange-traded fund has gained about 18.1% over the past year. Moreover, CEG’s returns on a YTD basis outshine the ETF’s 14.4% gains over the same time frame.

Constellation Energy's outperformance is driven by its strong performance of its zero-carbon nuclear fleet, favorable clean energy credits, and growing demand from corporate buyers. A notable 20-year power agreement with Meta Platforms, Inc. (META) reinforces its position as a top utility provider to tech giants. With a supportive clean energy policy environment and the Calpine acquisition on track, CEG is poised for continued growth and earnings visibility.

Recently, on Aug. 7, CEG shares closed down marginally after reporting its Q2 results. Its adjusted EPS came in at $1.91, up 13.7% year over year. The company’s revenue advanced 11.4% year over year to $6.1 billion.

For the current fiscal year, ending in December, analysts expect CEG’s EPS to grow 8.9% to $9.44 on a diluted basis. The company’s earnings surprise history is impressive. It beat or matched the consensus estimate in each of the last four quarters.

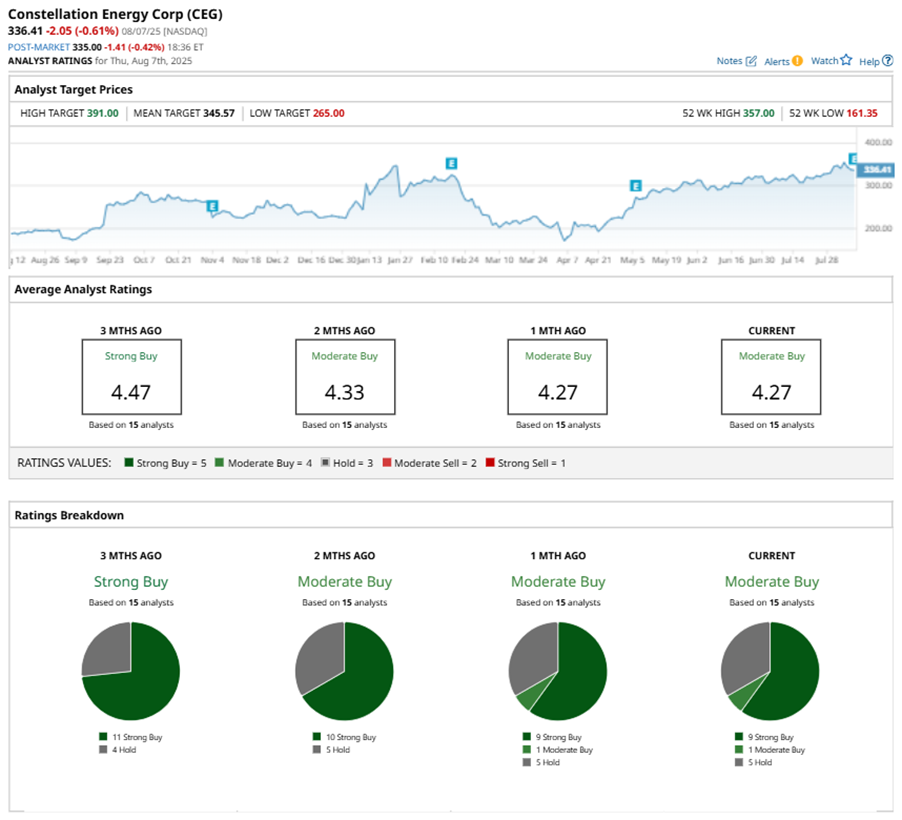

Among the 15 analysts covering CEG stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.”

This configuration is less bullish than two months ago, with 10 analysts suggesting a “Strong Buy.”

On Jul. 28, Jeremy Tonet from JPMorgan Chase & Co. (JPM) maintained a “Buy” rating on CEG with a price target of $390, implying a potential upside of 15.9% from current levels.

The mean price target of $345.57 represents a 2.7% premium to CEG’s current price levels. The Street-high price target of $391 suggests an upside potential of 16.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.