Is Wall Street Bullish or Bearish on MetLife Stock?

/Metlife%20Inc%20billboard-by%20monticello%20via%20Shutterstock.jpg)

With a market cap of $49.6 billion, MetLife, Inc. (MET) is a global financial services company that specializes in insurance, annuities, employee benefits, and asset management. Operating across multiple regions, it offers a wide range of protection, retirement, and savings products to both individual and institutional customers worldwide.

The New York-based company's shares have underperformed the broader market over the past 52 weeks. MET stock has increased nearly 6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 21.9%. Moreover, shares of MetLife are down 9.9% on a YTD basis, compared to SPX’s 7.8% rise.

In addition, the insurer stock has also lagged behind the Financial Select Sector SPDR Fund’s (XLF) 22.2% return over the past 52 weeks.

Shares of MetLife fell 2.8% after it reported Q2 2025 adjusted EPS of $2.02, missing analysts’ consensus estimate. Adjusted revenue came in at $17.9 billion, below forecasts, as adjusted premiums, fees, and other revenues declined 6% to $12.7 billion due to weaker underwriting margins in life and non-medical health products. This weakness outweighed a 9% increase in net investment income to $5.7 billion, leading investors to react negatively.

For the fiscal year ending in December 2025, analysts expect MET’s EPS to grow 10.5% year-over-year to $9.11. However, the company’s earnings surprise history is weak. It missed the consensus estimates in the last four quarters.

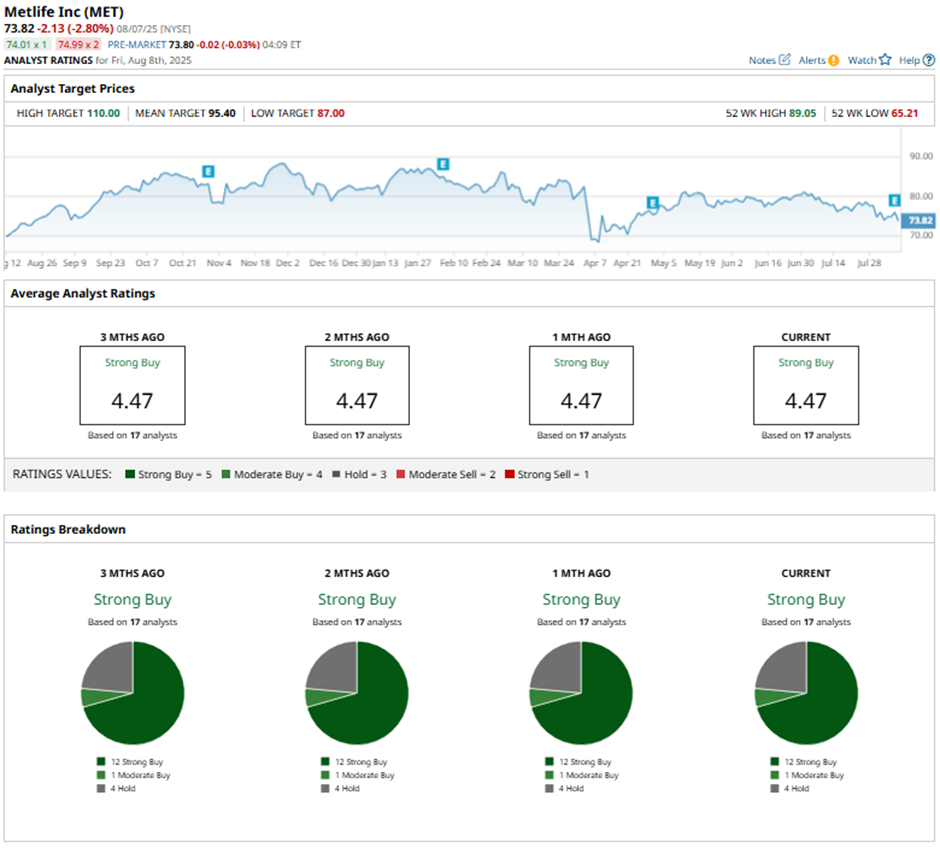

Among the 17 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

On Jul. 7, Barclays raised MetLife’s price target to $94, maintaining its “Overweight” rating.

As of writing, the stock is trading below the mean price target of $95.40. The Street-high price target of $110 implies a potential upside of 49% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.